How are we doing?

Monthly Economic Review paints a mixed picture.

New Zealand’s economy isn’t in great shape, but things could be worse.

What that means for the property market is anyone’s guess. Though, encouragingly, the real estate market bucked the recessionary trend. More on that below.

Here are the facts:

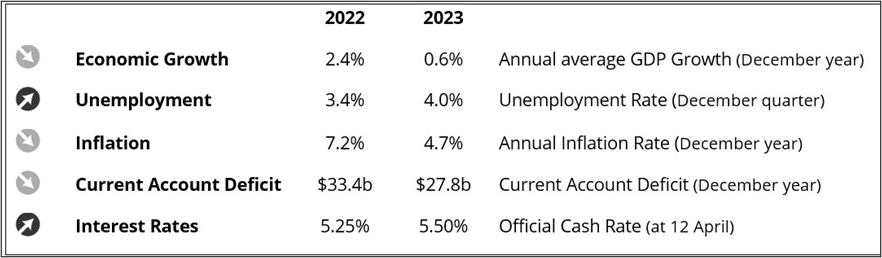

We’re in a technical recession – New Zealand’s gross domestic product (GDP) contracted by 0.1% in the December 2023 quarter, which followed a contraction in the September quarter.

Two consecutive quarters of shrinking economic activity is a recession.

You’re not just feeling poorer, you most certainly are.

Westpac’s most recent economic bulletin estimates the contraction may equate to a 4% drop in GDP per person (from a peak in mid-2022).

But it’s not all gloom

Figures in the latest Monthly Economic Review (published 15 April) show that the overall contraction in GDP in the December quarter was unevenly spread – eight of the 16 industries recorded an expansion in value-added output.

Rental, hiring, and real estate services industry expanded by one percent in the quarter, and made the largest growth contribution.

Summer has seen a return to more normal levels of real estate market activity after a relatively subdued 2023.

Nationwide inventory levels increased by 13.5% from 29,284 to 33,245 properties year-on-year – the highest level since 2015.

The number of new listings was up 23.9% year-on-year, to 11,455. Auckland had 31.4% more listings.

The house price index, which indicates the movement in house values, was down 1.2% from February, but up 2.6% from March 2023. Auckland’s HPI was up 2.2% from March 2023.

Average house prices rose by 0.5% in March 2024 according to CoreLogic, with an average price of $934,806 nationally. When compared to 12 months earlier, average prices were 0.1% higher.

Monthly Economic Review – April 2024

Unemployment is trending up

Unemployment is now 4% (December 2023 quarter) – up from 3.9% in the third quarter of 2023.

These figures are a return to 2019 levels, following recent historic lows part of the ‘peak COVID’ economic period from 2021 to 2022.

Underutilisation, a broad measure of spare capacity in the labour market, also increased to 10.7% in the December quarter, up from 9.3% in the December 2022 quarter.

The Employers and Manufacturers Association (EMA) reckons the reality is worse than the figures suggest.

“These numbers are from the last three months of 2023. We know anecdotally that the economic situation has further deteriorated, and the real unemployment rate today is likely to be higher,” Employers and Manufacturers Association (EMA) Head of Advocacy Alan McDonald said.

He also said increasing costs and rising interest rates were not only impacting consumer discretionary spending, but also increasing business financing costs, causing companies to look at their staffing as a way to cut costs.

Inflation – a promising decrease

Latest Consumer Price Index (CPI) data shows a promising decrease in the annual rate of inflation (disinflation), from 7.2% in December 2022 to 4.7% in December 2023.

Higher consumer prices in the December 2023 quarter were driven by higher housing rental costs (+ 1.1%), insurance premiums (+ 3.3%), and cigarettes and tobacco prices (+ 3%). Vegetable costs eased by 14.9% following an increase in seasonal supply.

Most economic forecasters are picking the annual inflation rate to ease back to within the Reserve Bank’s 1 – 3% medium term inflation band in the second half of 2024.

Treasury’s Budget Policy Statement 2024 has annual inflation easing to 2.6% in the September 2024 quarter. Banks including ANZ, ASB, and BNZ are in general agreement.

Current account balance – improving but still grim

New Zealand’s current account deficit is improving, largely thanks to the return of overseas tourists. The deficit totalled $27.8 billion for the 2023 calendar year – equivalent to 6.9% GDP. The annual current account deficit peaked at $33.4 billion in the 2022 calendar year (8.8% GDP).

That’s a nice narrowing of the deficit, but the figures mean that during the two-year period, New Zealanders spent more than $61b more than they earned overseas.

Interest rates easing, but monetary settings remain on “the restrictive side”

Both short-term and long-term wholesale interest rates eased during the month of March, reflecting financial market expectations that any further increase in the official cash rate (OCR) is unlikely (the Reserve Bank left the OCR steady at 5.5% in April).

Borrowers are second-guessing the Reserve Bank (RBNZ), moving to shorter term mortgages, even though it will cost them more.

Property research firm CoreLogic’s latest housing report shows 56% of new housing loans in February were fixed for one year, compared to 36% in December.

Chief economist Kelvin Davidson said borrowers have decided mortgage rates have peaked and were headed lower, which was driving the trend to short-term loans.

The ASB expects the Reserve Bank will commence cutting the official cash rate in November, with monetary settings remaining “…on the restrictive side of neutral for a year or so beyond that”.

For those of you who like to get down in the weeds with economic data, click here to read the full report. Otherwise, call 0800 GOODWINS for our take on current economic conditions and what it means for the local real estate market.