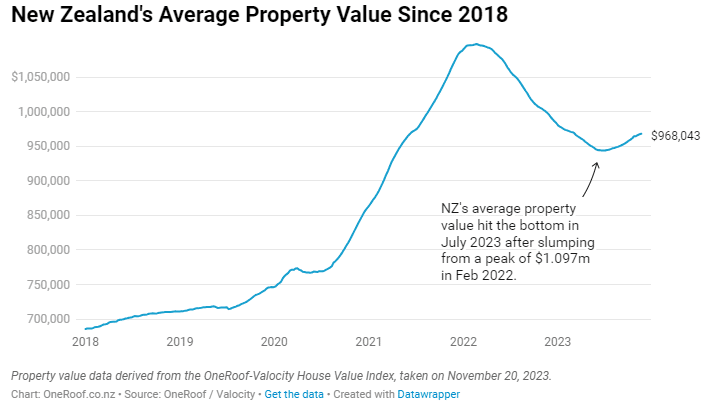

Average house prices have ticked up from their trough last year in July, mortgage rates are tipped to fall, and immigration remains at record high levels. Is this the year of house price growth?

Quotable Value’s (QV) latest house price index recorded a 0.6% uptick to $905,070 in the average house value across the country, for three months to the end of December.

Auckland house price increases were slightly bigger at 1.9%, nudging the average property price in the Big Smoke to $1,285,521.

However, growth is patchy – Auckland’s current growth rate was lower than the 2.8% recorded in the November quarter. Similarly, the nationwide growth rate was well down from the 2.3% recorded in the same prior period.

Some pundits argue that the recent decline in growth rate is the result of increasing stock available for purchase, which has helped rebalance supply and demand.

Nevertheless, bank economists are picking a gradual increase in house prices of between 5 and 8% throughout 2024, off the back of record immigration during 2023, expectations that longer-term mortgage rates are likely to move lower, and the reintroduction of interest deductibility for property investors.

What the experts say

- BNZ chief economist Mike Jones is predicting modest growth.

“I think it’s clear the market has stabilised but it’s not roaring away. We have a 7% increase for house prices on the board and we still think that’s a reasonable assumption. We still have high mortgage rates and while demand is picking up it’s still patchy,” he said.

- ASB chief economist Nick Tuffley also tipped a 7% increase over 2024.

“We’re putting another Hamilton into New Zealand, and those people are needing somewhere to live and that’s going to create demand,” he said. “The pace of the market at the moment is very gradual but we do expect it to get more of a head of steam in 2025 when we also expect interest rates to start coming down”.

- ANZ economist Andre Castaing offered a more conservative outlook, suggesting that higher mortgage rates and a softer labour market would stifle borrowing capacity and demand, cooling house price increases.

“It’s hard to tell the timing… but we do think that house prices are likely go through a period of cool growth in 2024,” he said. “House prices are one of the main things that drive economic activity in New Zealand and residential investment. The Reserve Bank wants to cool the economy and part of that is cooling the housing market.”

- Jarrod Kerr, Kiwibank chief economist, expected 5 to 7% increase in house prices, citing potential mortgage interest rate cuts throughout 2024, immigration, a reduction in the bright-line test and mortgage interest deducibility.

“We’ve just imported 120,000-odd people, which is massive and if you think that there’s 2.5 people per house, there’s at least 40 to 50,000 homes that we need to build just for the people that we’ve imported in the last year,” he said. “Investors haven’t been as influential in the last couple of years as they normally are. We’re expecting them to come back in and we’re hearing very early anecdotes they are, so what we’re tipping for rates is probably on point”.

- Westpac chief economist Kelly Eckhold expected house prices to rise by about 8%. “We don’t see any further cooling in the market. House sales and volumes and prices should continue to track higher, but it’s not boom market by any stretch, but growth will outstretch inflation over the next 12 months,” he said. “We anticipated the second half of 2023 would see house prices continuing to fall and that just hasn’t been the case. The thing that has really turned that around is the shift in migration and the public feeling more confident we’ve reached the bottom and stepping into the market.”

Economists appear to be singing from the same song sheet. But predictions are rarely a sure bet. As the idiom goes: Economists have successfully predicted nine of the last five recessions.

Still, things are looking a little frothier than they did last year.

The market is changing – but selling hasn’t. It’s about connecting appealing properties with the right buyers. Call 0800 GOODWINS to discuss listing your property and how we reach your ideal market.