Flatlining

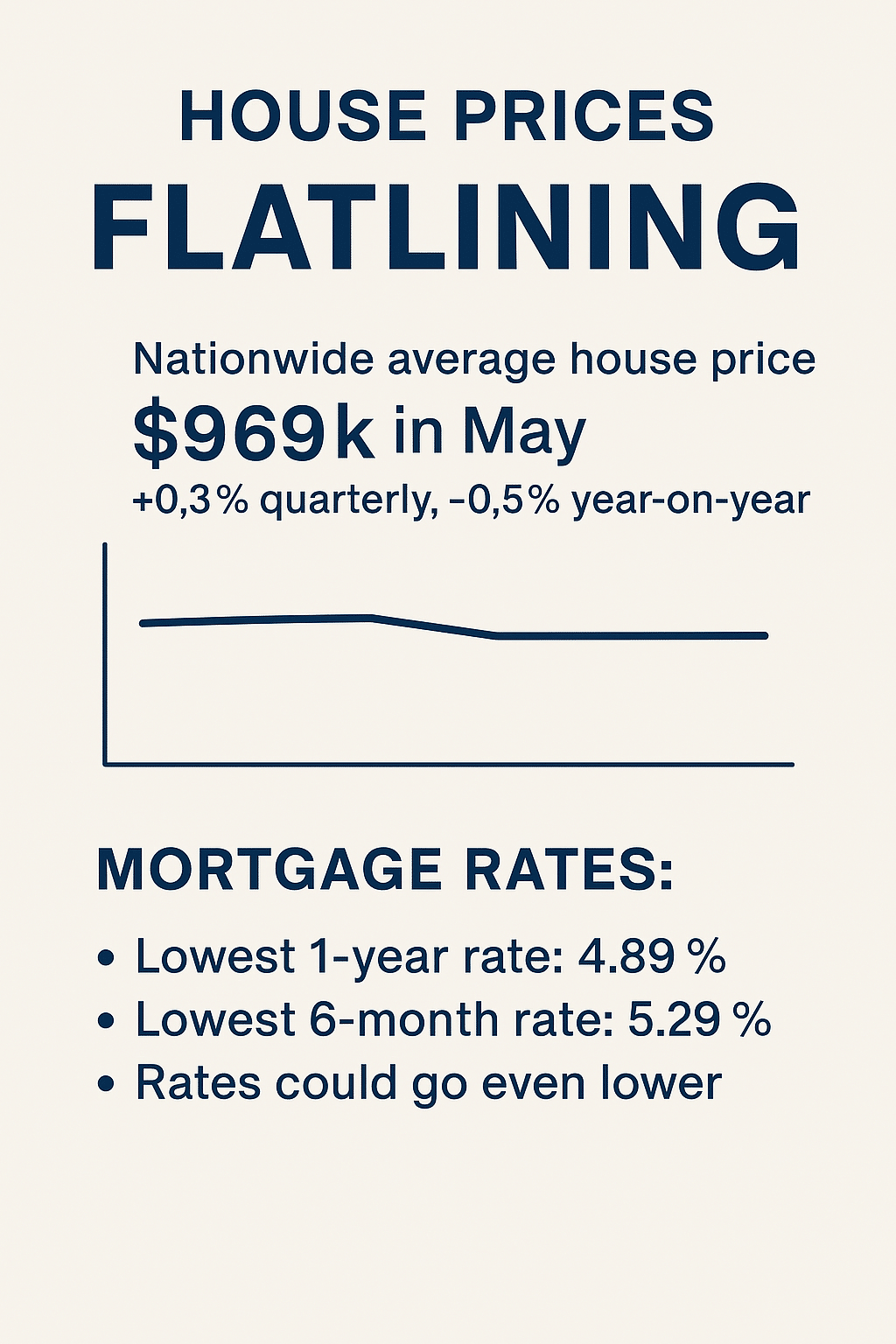

The nationwide average house price hit $969k in May – up a measly 0.3% quarterly but down 0.5% year-on-year. That’s essentially flatlining.

However, while Auckland properties continue their impression of a deflating balloon (down 0.2% in three months), Christchurch house prices are nearing their post-Covid peak — just $4,000 below the June 2022 high.

Why the split? Simple economics, according to Valocity’s Wayne Shum:

“Christchurch is definitely more affordable. During the boom, a lot of people in Auckland and Wellington thought, ‘In Christchurch, I’m buying a bigger house and a bigger section for less money.’ And job-wise, you’re not being paid a lot less to be in Christchurch.”

Meanwhile, Queenstown-Lakes largely escaped the slump, with its average property hitting a record high of $1.92m in February 2023 before dropping just 2.9% to $1.86m nine months later. Since then, prices have grown by 12.6%, reaching a new high of $2.099m in May this year.

Reality check: Some pundits predict that Auckland house prices won’t return to their post-Covid highs until late 2028, while Wellington homeowners will have to wait until 2031. Hmmm.

Mortgage Rates: The Descent Continues

The days of 7% rates are well and truly behind us. In late May, the Reserve Bank (RBNZ) cut the OCR by 25bps to 3.25%, and banks are jostling to offer the sweetest lending rate.

-

The lowest 1-year fixed mortgage interest rate is 4.89% (Kiwibank)

-

The lowest 6-month fixed mortgage interest rate is 5.29% (Kiwibank and ASB)

-

BNZ, ASB, and ANZ all have an 18-month fixed mortgage rate of 4.89% — the lowest it’s been since April 2022

Rates Could Go Even Lower

ANZ and Kiwibank think the OCR will be cut to 2.5%; ASB and BNZ forecast 2.75%; and Westpac thinks the OCR will bottom out at 3%. More rate cuts are likely to come, but we’re getting close to the bottom.

Debt-to-Income Reality Check

The RBNZ’s new debt-to-income (DTI) ratios are now live.

Owner-occupiers can only borrow up to six times their household income, while property investors face a limit of seven times their annual household income. Banks can still lend to 20% of borrowers above these limits (good luck getting into that club).

When interest rates are high, it’s hard to borrow much because it’s more expensive, and borrowers can afford less. As a result, only 6–7% of lending has gone to high-DTI borrowers (as of late 2023). That means DTIs haven’t impacted the lion’s share of bank lending — yet.

However, as rates drop and borrowing becomes cheaper, DTI limits will bite harder. Your equity-rich, cash-flow-poor strategy just got more complicated.

If You’re Waiting

Don’t hold your breath for a dramatic crash. While we may not see big house price increases anytime soon, prices are likely to inch up. That’s because lending growth is tied to wages, and wages tend to increase by at least 4% a year on average.

In the meantime, consider fixing rates for 1–2 years to ride the cutting cycle, and stress-test portfolios against the new DTI reality. Because in this market, it’s not just about what you can afford today — it’s about what the bank will let you borrow tomorrow.

Got questions about your portfolio strategy? Hit reply or call 0800 GOODWINS to make an appointment with one of our experts.